KYC & KYB

Create customised onboarding flows, verify individual customers and legal entities and conduct KYC and KYB checks with ease.

Fully Customisable Flows

Create custom flows for users or use cases. Build user journeys with our no-code, drag-and-drop interface. azakaw’s fully customisable flows enable you to define and set actions or ‘flows’ for end-users. This ensures you can set the fields required to capture information as part of the verification process.

Know Your Customer and Know Your Business

Identify natural persons and legal entities. Verify the ownership and control structures of legal entities. Manage all customer data through a single source and ensure that you continuously meet regulatory requirements.

ID and Biometric Verification

Automate the process of capturing and authenticating identity documents such as passports, ID cards, driver’s licenses, visas and more. Conduct liveness tests to authenticate identity to detect and stop ID fraud. Ensure all IDs remain current with our automated expiration and renewal workflow. Powered by AI, azakaw’s secure onboarding solution ensures a seamless onboarding process.

Identity Verification

- Extensive database of 13,000+ ID templates from 247 countries and territories

- Advanced hologram validation for forged document detection

- Swift NFC verification via your smartphone

Biometric Verification

- Advanced face capture and recognition

- Liveness detection for remote identity verification

- Facial attributes evaluation – estimating age range, facial expression and presence of facial hair

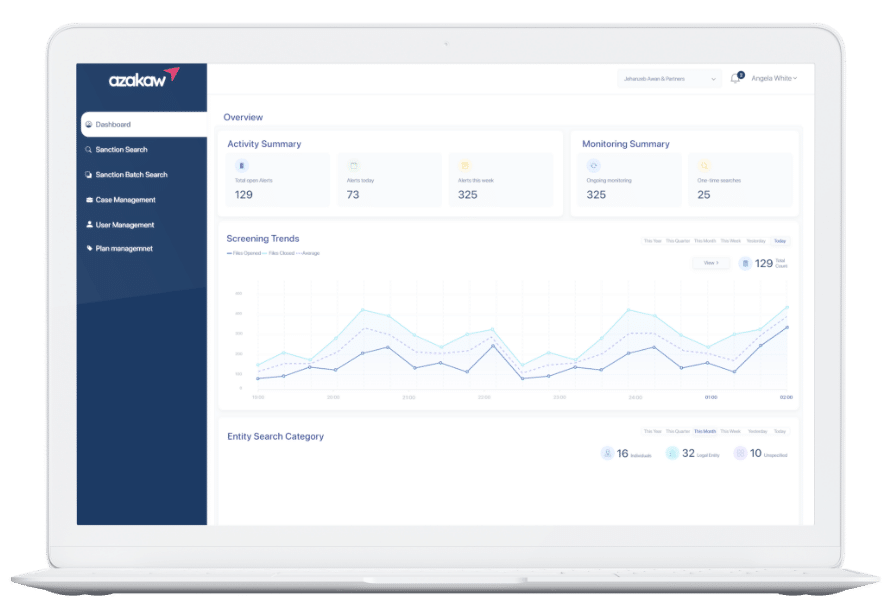

Sanctions, PEPs and Negative News Assessments

Go beyond watchlists and obtain the most up-to-date, accurate data sourced directly from regulatory and/or government authorities. See connected entities, enabling you to go beyond the immediate client in question. Our global AML risk management solution with advanced, customisable search filters enhances risk identification.

FATCA & CRS Compliance

Capture and report tax-related information of your clients. Utilise our intelligent workflow, which enables clients to provide the relevant information with ease. Access readymade reports that save you weeks and months of data reconciliation time.

Directors and UBO Data Capture

Identify, document and manage UBO and director information at inception and on an ongoing basis. Connect directors and UBOs across entities to capture the full extent of your exposure to each individual.

Client Classification Assessment

Meet client classification requirements through our easy-to-use data-capturing capability. Use our AI-driven engine to assess client classification status and maintain it periodically.

Investor Suitability Risk Assessment

Gain comprehensive insights into a client’s investment risk appetite. Customise the risk assessment based on our templates or completely create your methodology. We connect with your trading systems to identify potential breaches of suitability risk.

AI-Driven Risk Assessments

Leverage our machine learning algorithms to assess a client’s AML risk profile. Predict future risks score based on behavioural analysis of historical data, including events such as security incidents and compliance breaches.

Other Products

Streamline your

compliance processes

Curious to learn more about what we do or, interested in an in-depth demo of azakaw? We are here to help.