Results:

The integration of azakaw’s platform had a significant impact on Neovision’s operations.

- Onboarding Time Cut by 50%: The shift from manual processes to azakaw’s automated platform reduced client onboarding time by half. “What once took days now takes only hours,” Dr. Lemand notes.

- Improved Compliance Accuracy: Automation has drastically improved accuracy, eliminating mistakes during client onboarding. Dr. Lemand states, “There have been no more missed details or small errors.“

- Automated Sanctions Screening: In light of increased global sanctions, automated sanctions checks have become vital. “We used to perform these checks manually, but now they happen automatically. Every day, some of our clients are screened against international sanctions lists, which is critical for staying compliant.”

Customer

Neovision Wealth Management

Industry

Wealth Management

Intro

Neovision Wealth Management is a leading fund management and investment advisory firm incorporated in the Abu Dhabi Global Market (ADGM) and regulated by the Financial Services Regulatory Authority (FSRA) of ADGM. They have built a user-friendly digital platform that combines their expertise and access to an investment universe of over 35,000 securities and investment products. This platform brings all these resources together for the first time under one virtual roof.

Challenge

Before adopting azakaw, Neovision Wealth Management faced a fragmented KYC process. Compliance was managed manually through various documents, including Excel sheets, Word documents and PDFs. The team used email to send these files, leading to operational mistakes and delays. Dr. Lemand explains, “The process was messy, prone to error and slow. Everything was done manually, making client onboarding a time-consuming ordeal.”

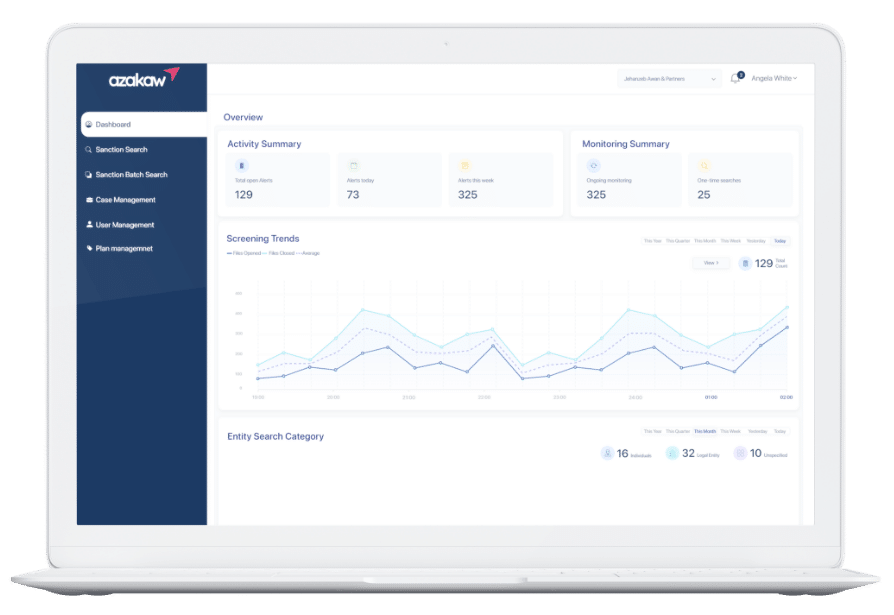

Solution

Through their existing partnership with j. awan & partners, Neovision was introduced to azakaw’s compliance platform. azakaw offered a streamlined experience that automated many of the previously manual tasks.

We used to rely on spreadsheets, documents and email attachments, which were prone to getting lost or exceeding size limits,” Dr. Lemand recalls. “Now, everything is on one platform. Nothing gets lost and we can trace every step, ensuring every KYC file is complete before submission.

User Experience:

Dr. Lemand’s team has shown a high level of satisfaction with azakaw’s platform. As with any new software implementation, some adjustments and clarifications were required during the early stages to ensure everything was functioning smoothly and the support team from azakaw has been strong in addressing these challenges. “Your team is very reactive, even during off hours,” Dr. Lemand says.

He highlights that the platform’s essential features meet their needs, although he prioritises reliability over additional features. “While other platforms may offer more bells and whistles, what matters most to me is stability. Fancy features are nice, but they can be distracting if they are not used frequently.”

Outcome:

azakaw has proven to be an excellent solution for Neovision Wealth Management. The platform’s automation, accuracy and time-saving capabilities have allowed Neovision to meet regulatory requirements and enhance the client experience.

“The implementation process was smooth and integrating it with our wealth tech platform was easy. Any issues we faced were quickly resolved,” says Dr. Lemand. “As sanctions and regulations evolve, having a proactive compliance platform like azakaw helps us stay ahead of the curve.”

Results:

The integration of azakaw’s platform had a significant impact on Neovision’s operations.

- Onboarding Time Cut by 50%: The shift from manual processes to azakaw’s automated platform reduced client onboarding time by half. “What once took days now takes only hours,” Dr. Lemand notes.

- Improved Compliance Accuracy: Automation has drastically improved accuracy, eliminating mistakes during client onboarding. Dr. Lemand states, “There have been no more missed details or small errors.“

- Automated Sanctions Screening: In light of increased global sanctions, automated sanctions checks have become vital. “We used to perform these checks manually, but now they happen automatically. Every day, some of our clients are screened against international sanctions lists, which is critical for staying compliant.”

Customer

Neovision Wealth Management

Industry

Wealth Management

Intro

Neovision Wealth Management is a leading fund management and investment advisory firm incorporated in the Abu Dhabi Global Market (ADGM) and regulated by the Financial Services Regulatory Authority (FSRA) of ADGM. They have built a user-friendly digital platform that combines their expertise and access to an investment universe of over 35,000 securities and investment products. This platform brings all these resources together for the first time under one virtual roof.

Challenge

Before adopting azakaw, Neovision Wealth Management faced a fragmented KYC process. Compliance was managed manually through various documents, including Excel sheets, Word documents and PDFs. The team used email to send these files, leading to operational mistakes and delays. Dr. Lemand explains, “The process was messy, prone to error and slow. Everything was done manually, making client onboarding a time-consuming ordeal.”

Solution

Through their existing partnership with j. awan & partners, Neovision was introduced to azakaw’s compliance platform. azakaw offered a streamlined experience that automated many of the previously manual tasks.

We used to rely on spreadsheets, documents and email attachments, which were prone to getting lost or exceeding size limits,” Dr. Lemand recalls. “Now, everything is on one platform. Nothing gets lost and we can trace every step, ensuring every KYC file is complete before submission.

User Experience:

Dr. Lemand’s team has shown a high level of satisfaction with azakaw’s platform. As with any new software implementation, some adjustments and clarifications were required during the early stages to ensure everything was functioning smoothly and the support team from azakaw has been strong in addressing these challenges. “Your team is very reactive, even during off hours,” Dr. Lemand says.

He highlights that the platform’s essential features meet their needs, although he prioritises reliability over additional features. “While other platforms may offer more bells and whistles, what matters most to me is stability. Fancy features are nice, but they can be distracting if they are not used frequently.”

Outcome:

azakaw has proven to be an excellent solution for Neovision Wealth Management. The platform’s automation, accuracy and time-saving capabilities have allowed Neovision to meet regulatory requirements and enhance the client experience.

“The implementation process was smooth and integrating it with our wealth tech platform was easy. Any issues we faced were quickly resolved,” says Dr. Lemand. “As sanctions and regulations evolve, having a proactive compliance platform like azakaw helps us stay ahead of the curve.”

Explore other success stories

Global Investment Firm’s Journey

What we're made of

Streamline your

compliance processes

Curious to learn more about what we do or, interested in an in-depth demo of azakaw? We are here to help.