Results:

With azakaw in place, the firm has achieved measurable improvements in its compliance processes:

- Consolidation of Data: All compliance data is now accessible on a single dashboard, making it easier to track risks and identify gaps.

- Efficient Onboarding: The firm successfully onboarded investors, vendors, business partners, employees, and internal group entities with greater efficiency.

- Regulatory Filing: azakaw enabled the firm to file its AML return for the first time, simplifying and streamlining the process.

- Improved Oversight: “We can now track risk levels for all stakeholders, clients, vendors, and employees, on a single platform,” the Head of Compliance said.

Conclusion:

The implementation of azakaw has been a game-changer for this global investment firm, enabling them to transform their compliance processes and confidently navigate the complexities of the financial services sector. As a trusted compliance platform, azakaw continues to empower its users to achieve operational excellence and regulatory success in an evolving landscape.

Customer

Global Investment Firm

Industry

Asset Management

Intro

A leading asset management firm operating in the Dubai International Financial Centre (DIFC) sought to significantly modernize its compliance and KYC processes to keep pace with its growing operations. Through its existing collaboration with j. awan & partners, the firm was introduced to azakaw, an advanced RegTech platform. Since its implementation, azakaw has delivered significant efficiencies and elevated the firm’s compliance framework.

Challenge

Before adopting azakaw, the firm relied on manual processes for handling KYC and compliance tasks, this setup created significant operational inefficiencies.

The firm managed over 150 clients, 40 vendors, and 20 employees in the DIFC, making manual tracking unsustainable. “The increasing scale of operations highlighted the limitations of our existing systems and processes,” the Head of Compliance added.

Solution

To address its needs, the firm implemented azakaw, a state-of-the-art compliance platform designed to simplify and automate KYC processes.

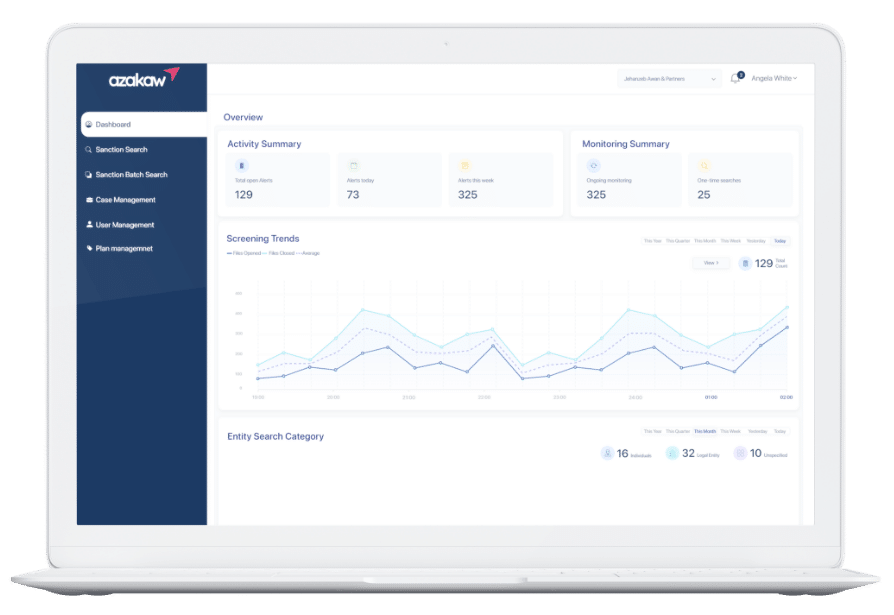

“azakaw has been a very useful visual tool for us,” the Head of Compliance explained. “At any time, I can easily see all our stakeholders, clients, employees, vendors, and business partners and their associated risk levels. The platform consolidates this data in one place, providing clarity and oversight.”

Additionally, azakaw’s robust risk rating system has enabled the firm to align its compliance practices with both DIFC and fund administrator requirements.

Key Benefits of azakaw’s Solution

- A centralized dashboard offering real-time insights into compliance data.

- Automated risk categorization of stakeholders based on low, medium, or high risk.

- Streamlined KYC onboarding with pre-populated forms and digital approvals, ensuring a seamless process.

- Built-in compliance tools, including sanctions discounting and adverse media monitoring.

User Experience

The firm’s compliance team has seen substantial benefits since implementing azakaw. Onboarding investors, vendors, and business partners has become significantly more efficient, while azakaw’s intuitive dashboard enables quick identification of compliance gaps.

“Our AML return filing process has been transformed by azakaw. For the first time, we used the platform to streamline this regulatory requirement, saving us time and ensuring accuracy,” said the Head of Compliance.

The firm has also leveraged azakaw’s dynamic reporting capabilities to strengthen its compliance oversight, ensuring that all stakeholders meet the required regulatory standards.

Outcome

The adoption of azakaw has brought measurable improvements to the firm’s compliance operations:

- Enhanced Efficiency: Automated processes and centralized data have significantly reduced the time spent on manual compliance tasks.

- Improved Oversight: Real-time insights into stakeholder risk levels and compliance gaps provide greater operational clarity.

- Streamlined Onboarding: The firm successfully onboarded clients, vendors, employees, and group entities with ease, reducing paperwork and manual effort.

- Regulatory Excellence: azakaw has supported the firm in meeting regulatory requirements, including streamlined AML return filings and comprehensive compliance reporting.

“azakaw has exceeded our expectations by providing us with a consolidated dashboard and tools that empower us to operate with confidence in a highly regulated environment,” the Head of Compliance concluded.

With azakaw in place, the firm has achieved measurable improvements in its compliance processes:

- Consolidation of Data: All compliance data is now accessible on a single dashboard, making it easier to track risks and identify gaps.

- Efficient Onboarding: The firm successfully onboarded investors, vendors, business partners, employees, and internal group entities with greater efficiency.

- Regulatory Filing: azakaw enabled the firm to file its AML return for the first time, simplifying and streamlining the process.

- Improved Oversight: “We can now track risk levels for all stakeholders, clients, vendors, and employees, on a single platform,” the Head of Compliance said.

Conclusion:

The implementation of azakaw has been a game-changer for this global investment firm, enabling them to transform their compliance processes and confidently navigate the complexities of the financial services sector. As a trusted compliance platform, azakaw continues to empower its users to achieve operational excellence and regulatory success in an evolving landscape.

Customer

Global Investment Firm

Industry

Asset Management

Intro

A leading asset management firm operating in the Dubai International Financial Centre (DIFC) sought to modernize its compliance and KYC processes to keep pace with its growing operations. Through its existing relationship with j. awan & partners, the firm was introduced to azakaw, an advanced RegTech platform. Since its implementation, azakaw has delivered significant efficiencies and elevated the firm’s compliance framework.

Challenge

Before adopting azakaw, the firm relied on manual processes for handling KYC and compliance tasks, this setup created significant operational inefficiencies.

The firm managed over 150 clients, 40 vendors, and 20 employees in the DIFC, making manual tracking unsustainable. “The increasing scale of operations highlighted the limitations of our existing systems and processes,” the Head of Compliance added.

Solution

To address its needs, the firm implemented azakaw, a state-of-the-art compliance platform designed to simplify and automate KYC processes.

“azakaw has been a very useful visual tool for us,” the Head of Compliance explained. “At any time, I can easily see all our stakeholders, clients, employees, vendors, and business partners and their associated risk levels. The platform consolidates this data in one place, providing clarity and oversight.”

Additionally, azakaw’s robust risk rating system has enabled the firm to align its compliance practices with both DIFC and fund administrator requirements.

Key Benefits of azakaw’s Solution

- A centralized dashboard offering real-time insights into compliance data.

- Automated risk categorization of stakeholders based on low, medium, or high risk.

- Streamlined KYC onboarding with pre-populated forms and digital approvals, ensuring a seamless process.

- Built-in compliance tools, including sanctions discounting and adverse media monitoring.

User Experience

The firm’s compliance team has seen substantial benefits since implementing azakaw. Onboarding investors, vendors, and business partners has become significantly more efficient, while azakaw’s intuitive dashboard enables quick identification of compliance gaps.

“Our AML return filing process has been transformed by azakaw. For the first time, we used the platform to streamline this regulatory requirement, saving us time and ensuring accuracy,” said the Head of Compliance.

The firm has also leveraged azakaw’s dynamic reporting capabilities to strengthen its compliance oversight, ensuring that all stakeholders meet the required regulatory standards.

Outcome

The adoption of azakaw has brought measurable improvements to the firm’s compliance operations:

- Enhanced Efficiency: Automated processes and centralized data have significantly reduced the time spent on manual compliance tasks.

- Improved Oversight: Real-time insights into stakeholder risk levels and compliance gaps provide greater operational clarity.

- Streamlined Onboarding: The firm successfully onboarded clients, vendors, employees, and group entities with ease, reducing paperwork and manual effort.

- Regulatory Excellence: azakaw has supported the firm in meeting regulatory requirements, including streamlined AML return filings and comprehensive compliance reporting.

“azakaw has exceeded our expectations by providing us with a consolidated dashboard and tools that empower us to operate with confidence in a highly regulated environment,” the Head of Compliance concluded.

Explore other success stories

Neovision’s Journey

What we're made of

Streamline your

compliance processes

Curious to learn more about what we do or, interested in an in-depth demo of azakaw? We are here to help.